About Our Business

Business scheme

Mitsui Fudosan Investment Advisors (MFIA) has provided investors with diverse solutions as a private fund and private REIT asset management company from the early days of the real estate securitization business. We employ various schemes according to the features of the real estate properties for investment and the needs of investors for each project.

In March 2012, we started management of Mitsui Fudosan Private REIT (MFPR), an unlisted, open-ended private REIT.

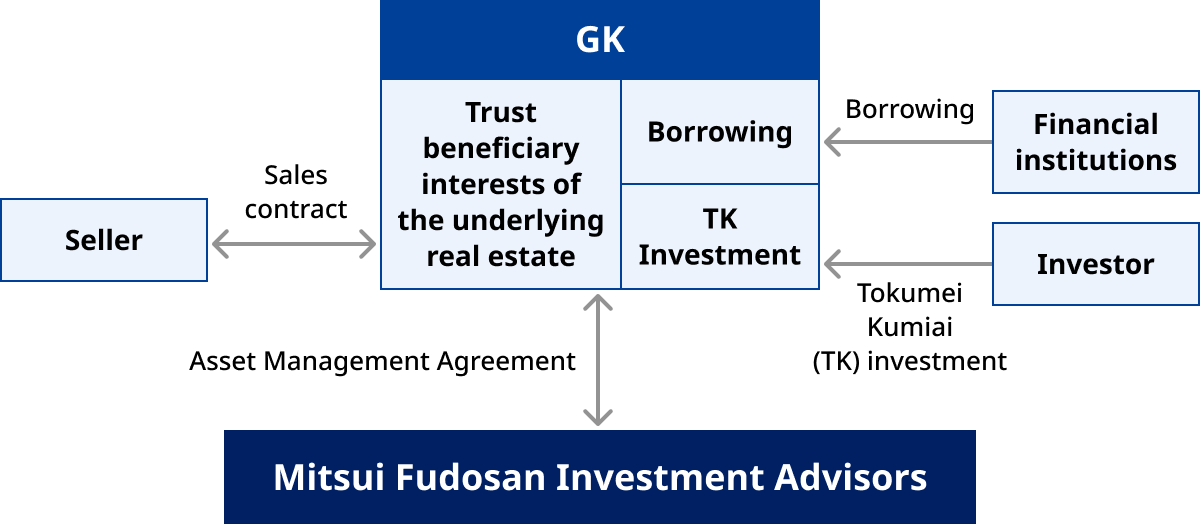

A GK/TK Structure

A GK(Godo Kaisha), a limited liability company, is established to act as the holder of the assets to be invested. This investment scheme is used to make the purchase of trust beneficiary interests of the underlying real estate using the capital invested by investors under an anonymous partnership (TK-Tokumei Kumiai) and borrowings from financial institutions.

Features

- Dividends to investors can be included in deductible expenses at the godo kaisha (GK, or limited liability company), therefore double taxation can be avoided.

- Investors (silent partners) have limited liability up to the amount of their invested capital.

- Fund formation and institutional management is relatively simple and there is high flexibility.

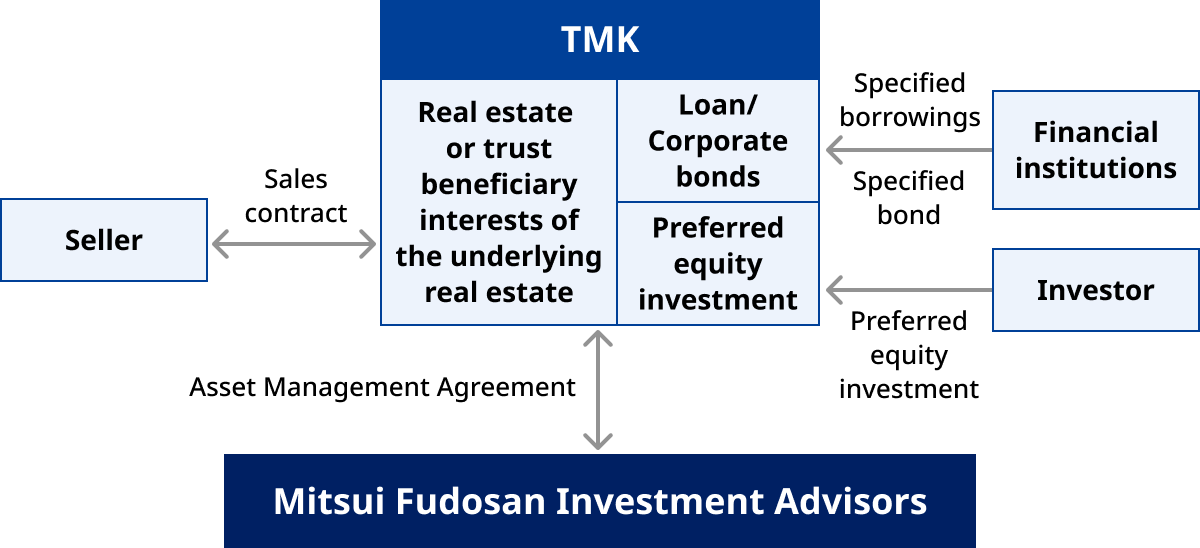

TMK Structure

A TMK(Tokutei Mokuteki Kaisha) is established in accordance with the Asset Liquidation Law to act as the holder of the assets to be invested. In this scheme, the purchase of real estate or trust beneficiary interests of the underlying real estate is funded by investors' preferred shares and the issuance of specified bonds or specified purpose borrowings from financial institutions.

Features

- By satisfying conduit requirements, double taxation can be avoided.

- Actual real estate and real estate for development may also become investment targets in addition to real estate trust beneficiary rights.

- Because TMKs are premised on management based on asset securitization plans, they are legally stable.

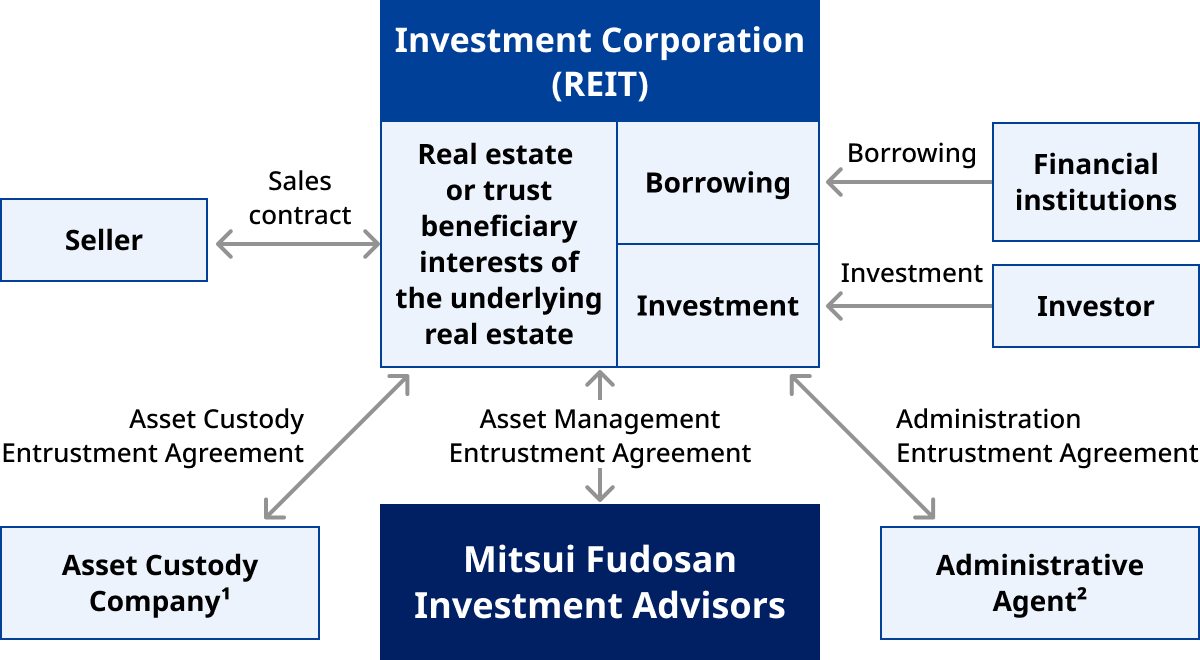

REIT structure

REITs, established in accordance with laws that govern investment trust and investment corporations, own properties held for investment purposes. REITs are legally prohibited from hiring employees and their business activities have to be externally managed. We are entrusted with the authority pertaining to asset investment. We make investments in real estate and real estate trust beneficiary interests using the capital of investors and borrowings from financial institutions.

- Custody of important assets including REITs-related pass books or contract documents and cash management is entrusted to a trust bank.

- Services including the arrangement of an investor meeting, management of a name list of investors, accounting and tax matters are entrusted to a trust bank, tax accountant corporation, and others.

Features

- By satisfying conduit requirements, double taxation can be avoided.

- Solid corporate governance is ensured through General Investors' Meetings and the Board of Directors.

- Full information disclosure is conducted based on the Act on Investment Trusts and Investment Corporations and on other rules.