Our Strengths and Investment Strategies

Five strengths

Mitsui Fudosan Investment Advisors draws on the strengths shown below to provide investorswith superior investment opportunities and asset management services.

- A solid track record in setting up and managing a variety of private funds and a private REIT

- A broad range of investors

- The Group's comprehensive strength

- Debt arrangement capabilities

- Management posture

01

A solid track record in setting up and managinga variety of private funds and a private REITA solid track record in setting up and managinga variety of private funds and a private REIT

We set up and manage funds of different formats,each targeting specific asset types such as office buildings, retail facilities,and leased residential properties.

- Mitsui Fudosan Investment Advisors manages various assets including office buildings, retail facilities, leased residential properties, and logistics facilities.

- We accommodate various fund management strategies including core, core plus, value-add, opportunistic, developmental, and warehousing.

Balance of assets under management (AUM)

-

-

- Properties managed by multiple funds are counted only once.

-

- The Tokyo metropolitan area includes Tokyo and the prefectures of Kanagawa, Chiba, and Saitama.

- Note: The asset type classification shown above is based on AUM as of March 31, 2025. Percentages of the asset types may not total 100% due to rounding.

- Note:The balance of AUM is the sum of the acquisition price of assets for which we have entered asset management contracts for or the appraised value of such assets at the time of contract conclusion.

- Note:Asset management contracts include those that fall under investment advisory contracts and discretionary investment contracts as defined by the Financial Instruments and Exchange Act, as well as investment advisory contracts and discretionary investment contracts as defined by the Rules on Registration of Real Estate Investment Advisory Business. Also included are contracts and other agreements such as those on the provision of management services for the ownership, operation, and management of assets not involving investment decisions on the purchase or sale of assets.

02

A broad range of investors

We are meeting the needs of over 200 diverse investors, including Japanese and overseas institutional investors, life and non-life insurance companies, pensions, and business companies.

03

The Group's comprehensive strength

We set up and manage funds making full use of the resources and comprehensive strength ofMitsui Fudosan—a leading developer in Japan—and its group companies,as well as the unique relationships and expertise that we have developedin the 20-plus years since our establishment.

Harnessing the Mitsui Fudosan Group's comprehensive strength

We take active and full advantage of the comprehensive capabilities of Mitsui Fudosan Group companies in the areas of information gathering, development, and management and operation to drive the external and internal growth of private REITs and private funds.

Acquisition, management, and operation of properties making use of group relations

-

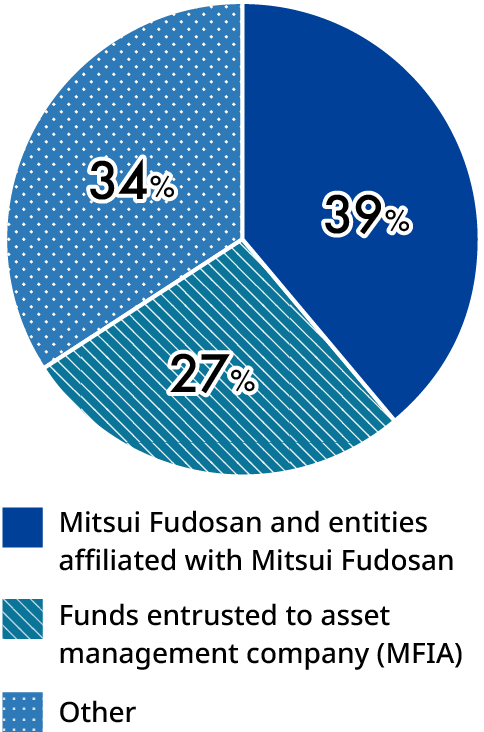

Attributes of property seller

-

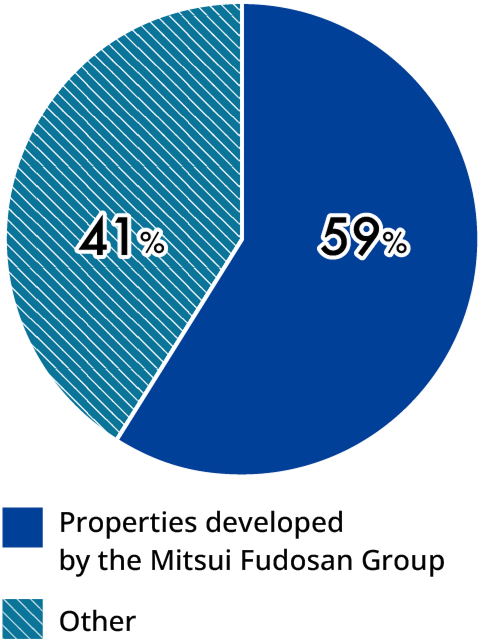

Share of properties developed by the Mitsui Fudosan Group among acquired properties

-

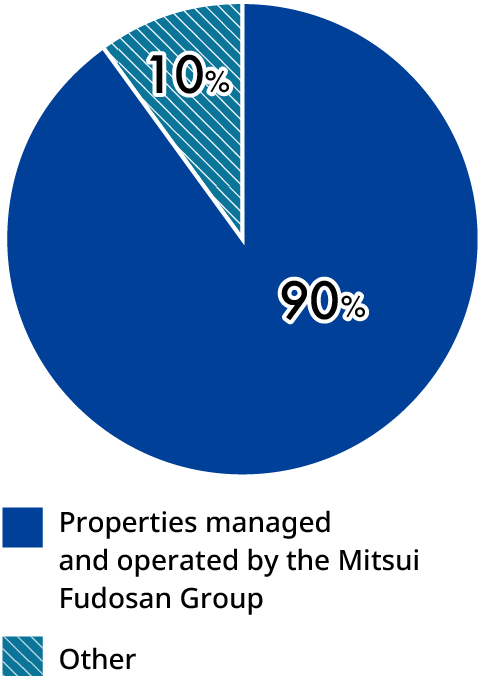

Share of properties managed and operated by the Mitsui Fudosan Group among owned properties

- Share of properties managed by Mitsui Fudosan Private REIT Inc.

- Based on acquisition price (as of the fiscal period ending June 2025).

04

Debt arrangement capabilities

We have established the Structured Finance Department, a dedicated financing team with strong fund procurement capabilities backed by our track record of numerous transactions with over 30 various financial institutions.

05

Management posture

We have built up a governance structure that ensures that our operations managing assets including those of funds are appropriate and fair. In addition, the operations team consists of personnel who are highly knowledgeable and experienced in real estate, finance, and other fields.