About Our Business

About Mitsui Fudosan Private REIT Inc.

Overview of MFPR

As a comprehensive private REIT with a diversified portfolio that includes a wide range of asset types and is designed for institutional investors, MFPR's asset size is one of the largest in Japan.

Taking full advantage of the Mitsui Fudosan Group's comprehensive strengths, we will continue to attain the steady growth of our assets and stable medium-to long-term income and returns.

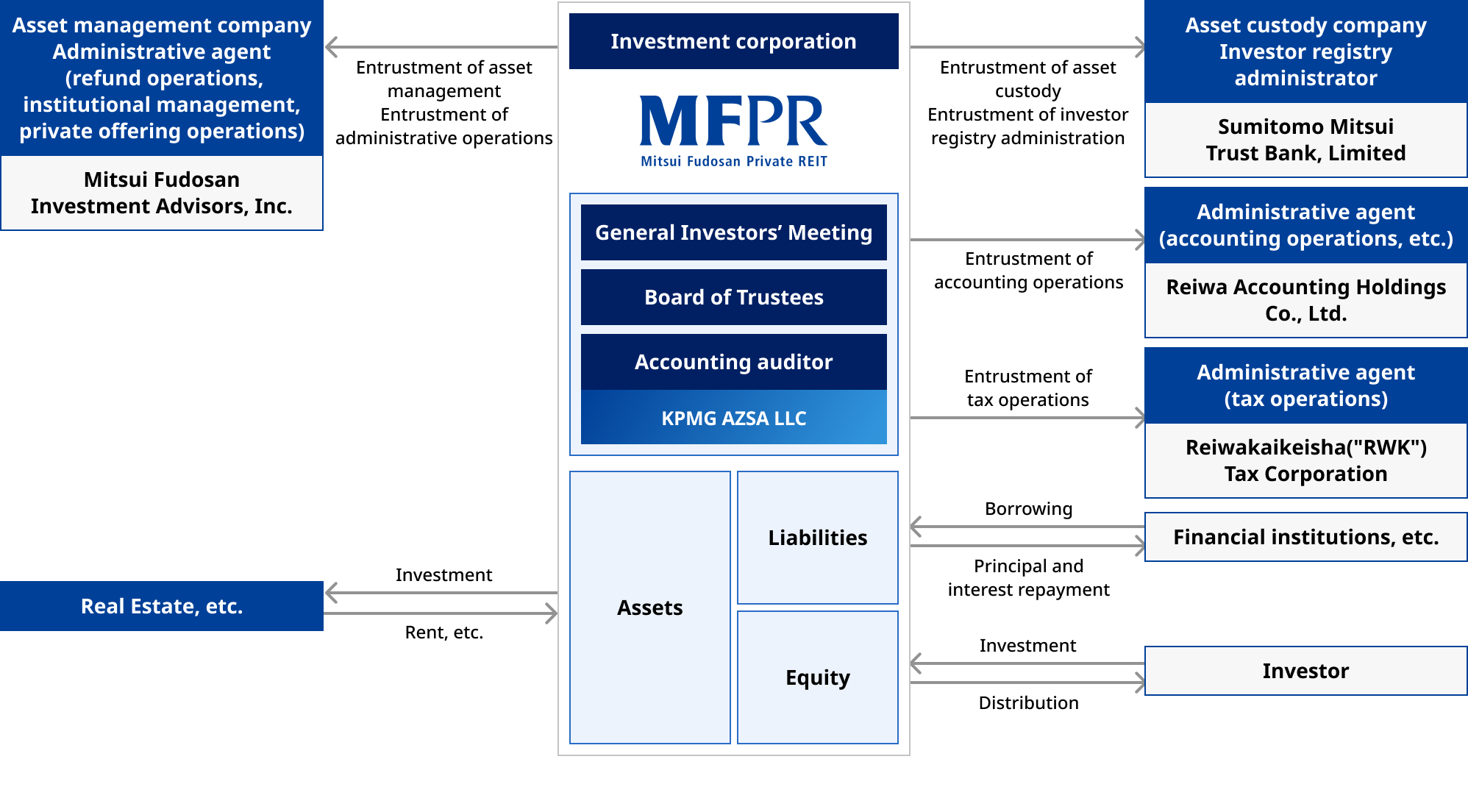

- Note: The diagram shows MFPR's key stakeholders, as well as the main flow of funds and some of the contractual relationships among them.

Features of MFPR

Income-focused products for long-term stable management

Taking advantage of Mitsui Fudosan Group's well-developed expertise, we provide income-focused products for long-term stable management that serves to supplement conventional private real estate funds and listed REITs. By offering comprehensive products that can leverage Mitsui Fudosan Group's comprehensive strengths, we seek to achieve higher management stability and the expansion of external growth opportunities.

Features of private real estate fund products

- Products can be customized for each investor.

- Because they are fixed-term funds, they tend to be impacted by real estate and financial market conditions at the end of their terms.

- Refinancing may be difficult in some cases depending on the debt ratio.

Features of listed REIT products

- Appropriate governance and information disclosure frameworks have been established.

- Because the products are listed, they are relatively liquid.

- They may be impacted more by stock market conditions than by value fluctuations of the real estate properties themselves.

Products designed for institutional investors focusing on long-term stable management.

- Utilizing investment corporations capable of establishing appropriate governance structures.

- Reducing the market value fluctuation risk of investment units by evaluating them based on NAV calculations derived from property value assessments.

- Reducing the impact of market fluctuations on asset sales by not setting a fixed term for the investment period.

- Reducing refinancing risks and minimizing fluctuations in equity value by maintaining low leverage.

- Ensuring a certain level of liquidity through refunds from investment corporations (open-end) or the transfer of investment units (matching).

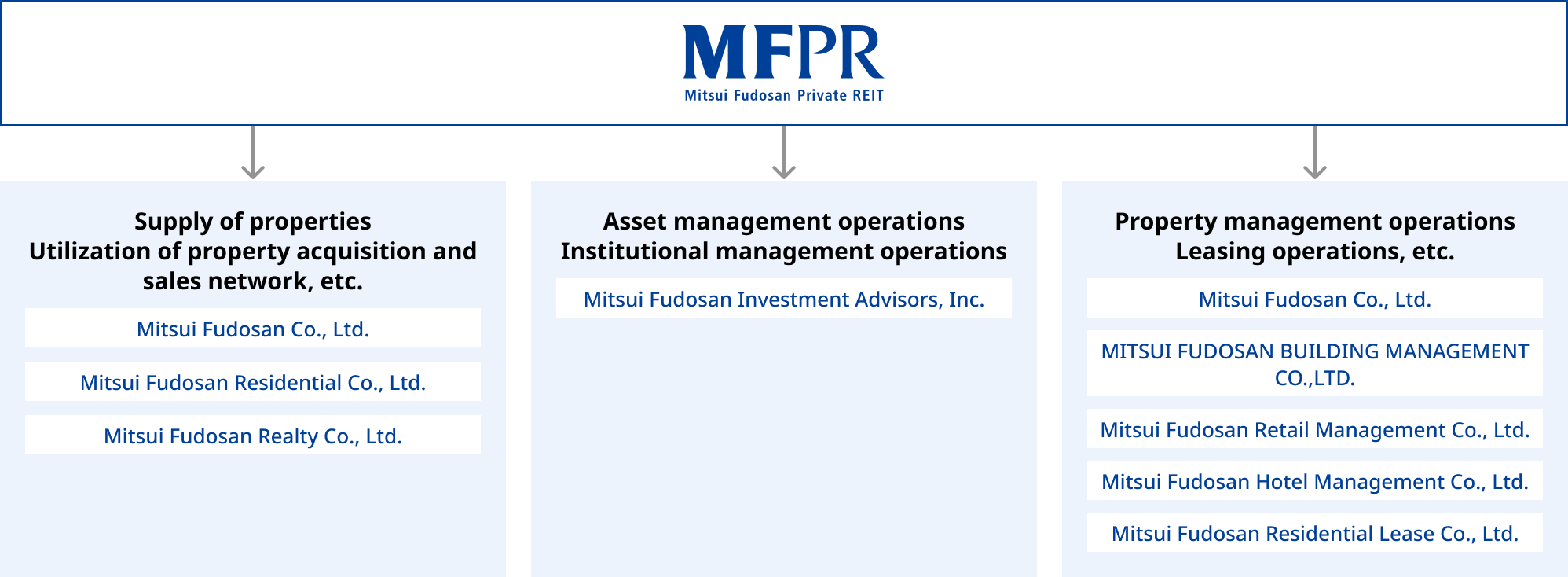

Taking advantage of the Mitsui Fudosan Group

MFPR takes full and active advantage of the comprehensive strengths of Mitsui Fudosan Group companies including those listed below. Specifically, it will harness their capabilities in the areas of information gathering, development, and management and operation to achieve MFPR's internal and external growth.

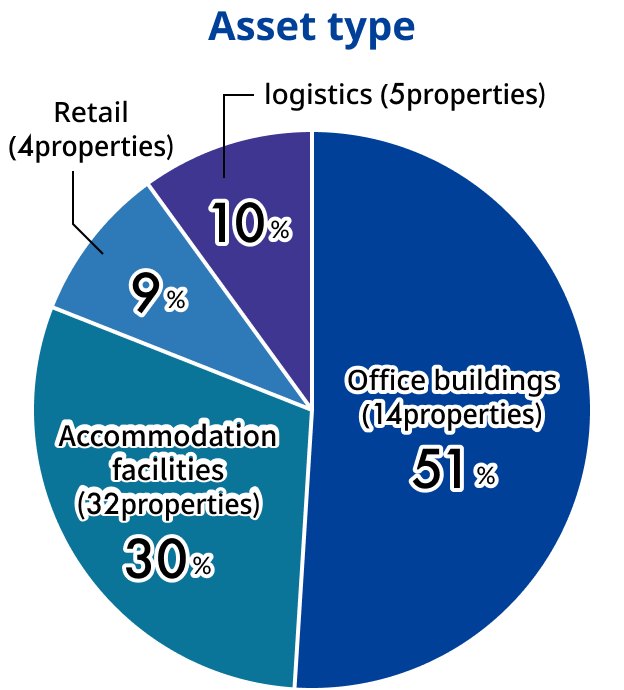

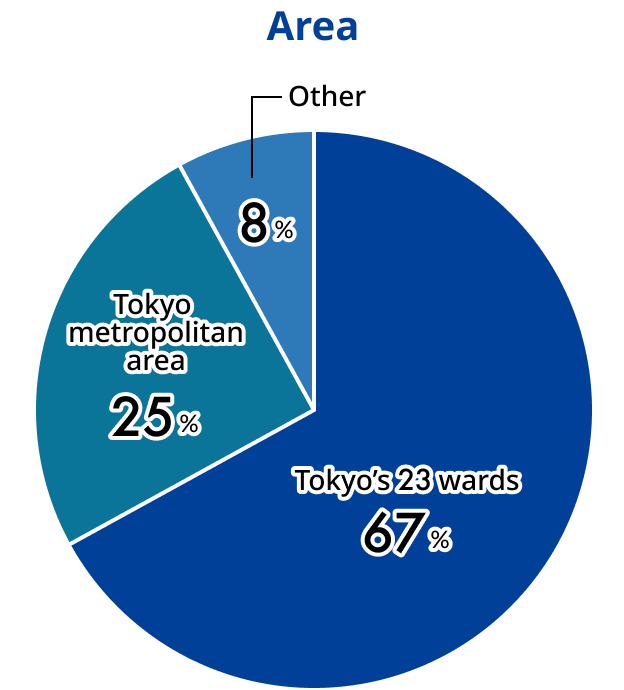

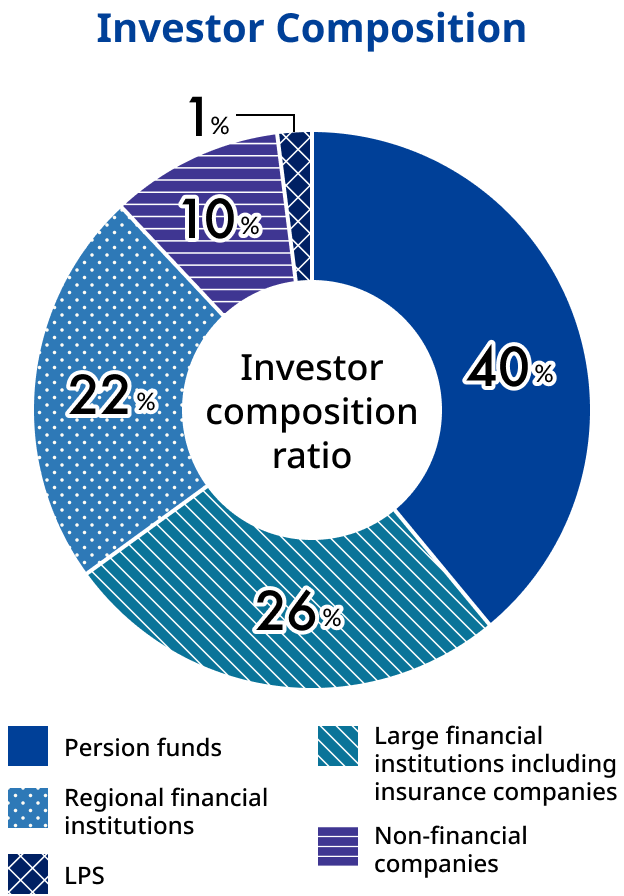

Asset composition and investor composition charts

Fund data

- (As of June 30, 2025)

| Assets | Approximately ¥431.0 billion (based on the acquisition price) |

|---|---|

| Properties | 55 properties |

| Asset classes | Office buildings, Residential, Hotels, Retail, Logistics |

| Investors | 207 companies |

| Loan-to-Value ratio | Approximately 36.2% |

- Based on acquisition price

- Based on acquisition price

- Due to rounding, the total may not add up to 100.0%.

Portfolio properties

Jimbocho Mitsui Building

Chiyoda-ku, Tokyo (completed in 2003)

Park Axis Aoyama 1-Chome Tower

Minato-ku, Tokyo (completed in 2007)

Mitsui Shopping Park LaLaport Shonan Hiratsuka

Hiratsuka City, Kanagawa Prefecture (completed in 2016)

Mitsui Fudosan Logistics Park Yokohama Daikoku

Yokohama, Kanagawa (completed in 2009)